Cryptocurrency can feel complex at first glance, but understanding the fundamentals can help you navigate this evolving space and asset class. Here’s a breakdown of common questions and clear answers to get you started in understanding cryptocurrency.

What is cryptocurrency?

Cryptocurrency is a type of money that only exists online. You can’t hold it in your hand like cash or coins. Instead, it’s stored and used through computers and smartphones .What makes it special is that it’s not controlled by any bank or government. But there is Government regulations when looking at Taxes (reporting gains/losses), Exchanges (where you buy/sell), and in general overall banking connections. People can send and receive it directly to each other, kind of like sending an email, but with money. It uses a special kind of technology called blockchain, which is like a digital notebook that keeps track of every transaction. This “notebook” is shared across thousands of computers, so each transaction can be verified among other users making it hard to falsify transactions and receipts.

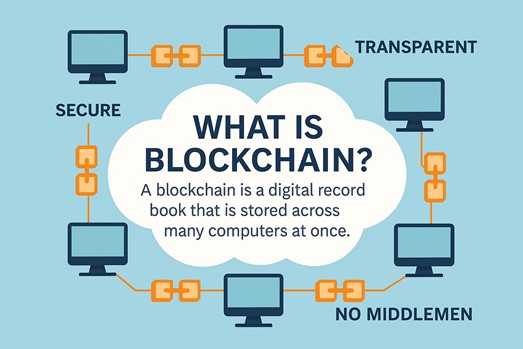

What is blockchain, and why is it important?

Imagine a notebook that keeps track of every time someone sends or receives money. Now imagine that this notebook isn’t kept by one person or bank—but instead, copies of it are shared with thousands of people around the world.

That’s what a blockchain is: a digital record book that’s stored on many computers at once. Every time someone makes a transaction, it gets added to this record, and everyone’s copy updates.

Here’s why it matters:

- It’s secure – once something is written in the blockchain, it can’t be erased or changed.

- It’s transparent – anyone can see the history of transactions.

- It doesn’t need a middleman – people can send money directly to each other without needing a bank

What are some of the major cryptocurrency names?

Just like there are big-name companies like Apple or Microsoft in the stock market, there are well-known names in the world of cryptocurrency.

Here are a few of the biggest ones:

- Bitcoin (BTC) – Market Cap: ~$2.19 trillion

- Ethereum (ETH) – Market Cap: ~$465 billion

- Binance Coin (BNB) – Market Cap: ~$149 billion

- Solana (SOL) – Market Cap: ~$101 billion

- Ripple (XRP) – Market Cap: ~$150 billion

- Cardano (ADA) – Market Cap: ~$22 billion

How are cryptocurrencies grouped by size?

Cryptocurrencies are often sorted into three groups based on their market cap:

- Large-cap (Over $50 billion): These are the most trusted and widely used. They’re like the “blue-chip” stocks of crypto. Examples: Bitcoin, Ethereum, Binance Coin.

- Mid-cap ($10–$50 billion): These are growing and have potential, but they’re a bit riskier. Example: Cardano.

- Small-cap (Under $10 billion): These are newer or less known. Their prices can move up and down relatively fast since they have a smaller market cap causing them to be more volatile.

Why does market cap matter?

Think of market cap like the size of a company. A bigger market cap usually means the cryptocurrency is more stable and trusted. Smaller ones might be exciting but can change quickly in value.

Is cryptocurrency legal and regulated?

Regulation varies by country. In the U.S., crypto is legal but subject to evolving regulations from agencies like the SEC and CFTC. Some countries embrace crypto, while others restrict or ban it.

What is a stablecoin?

A stablecoin is a type of cryptocurrency that is designed to stay at the same value, instead of going up and down like Bitcoin or other coins.

Stablecoins are usually tied to something real, like:

- U.S. dollars (most common)

- Gold

- Or other assets

This means for every stablecoin, there’s something backing it up to try and keep its value steady.

Examples of popular stablecoins

- USDT (Tether) – linked to the U.S. dollar.

- USDC (USD Coin) – also tied to the U.S. dollar.

- DAI – backed by crypto but still aims to stay near $1

How do people buy or sell cryptocurrency?

Buy Crypto Exposure Through ETFs

If you don’t want to deal with wallets or exchanges, you can invest in crypto ETFs through your regular brokerage account—just like buying stock.

- What is a Crypto ETF?

An ETF (Exchange-Traded Fund) is an investment fund you can buy like a stock. A crypto ETF tracks the price of Bitcoin, Ethereum, or a group of crypto-related companies. - Where can you buy them?

Platforms like:

-

- Charles Schwab

- Fidelity

- E*TRADE

Examples of Crypto ETFs:

- FBTC – Fidelity Wise Origin Bitcoin Fund (tracks Bitcoin)

- IBIT – iShares Bitcoin Trust

- HODL – VanEck Bitcoin ETF

Why choose ETFs?

- No need for a crypto wallet.

- Easier for traditional investors.

- Can be held in retirement accounts like IRAs.